Stainless Steel Market Size Worth $182.2 Billion By 2027

Nov 10, 2020

The global stainless steel market size was valued at USD 111.4 billion in 2019. It is expected to reach USD 182.2 billion by 2027, expanding at a CAGR of 6.3%, according to a new report by Grand View Research, Inc. Increased focus towards customized railing made of stainless steel in housing construction is anticipated to drive market growth over the forecast period.

China is one of the leading producers and consumers of stainless steel products globally owing to the growing end-use industries such as automotive, construction, and consumer goods. As per the International Organization of Motor Vehicle Manufacturers, China’s automotive production reached 27.8 million units and accounted for 29% of the global automotive production in 2018. The increasing production of automobiles is anticipated to drive the market for stainless steel over the coming years.

Construction is one of the largest end-use industries of stainless steel products. Various infrastructure and construction sites require a massive number of products to enhance the aesthetic appeal and corrosion resistance of the structure. The advantages that are offered by the product such as corrosion resistance, formability, weldability, and aesthetic appearance make it an important constituent in the construction industry. Stainless steel is majorly used in the construction industry for architectural cladding, handrails, drainage and water systems, wall support products, roofing, and structures and fixing.

Increasing the use of 200 series in consumer goods owing to its low cost and high strength is anticipated to drive demand for stainless steel. Because stainless steel is resistant to corrosion, exhibits high toughness and ductility, and requires low maintenance. The aforementioned properties of stainless steel have resulted in the increased utilization of the product in consumer products such as cookware, showpieces, and stoves, which in turn is anticipated to propel product demand over the coming years.

Increasing automotive production mainly in the emerging economies of Asia Pacific, Middle East, and South America is a major driving factor for the market for stainless steel. Growing population and increasing disposable income along with easy access to the credit facility and increasing necessity among people to own a vehicle are the significant factors propelling vehicle production in the emerging economies of Asia Pacific. This, in turn, is likely to augment market growth over the coming years.

Despite the growing product demand in various industries, the increasing usage of carbon fibers, especially in the automotive industry owing to properties such as lightweight, high strength, and load-bearing capacities are anticipated to critically impact the market for stainless steel over the coming years. The growing importance of lightweight vehicles to reduce fuel consumption is likely to increase the need for lightweight materials. Carbon fibers reduce the weight of a car by almost 30%, thus making it the most desirable material in the automotive industry.

Some of the key players in the stainless steel market are POSCO, Acerinox S.A., Jindal Stainless, Aperam Stainless, Baosteel Group, Outokumpu, ThyssenKrupp Stainless GmbH, Nippon Steel Corporation, ArcelorMittal, and Yieh United Steel Corp. The key players are focusing on capacity expansions and long-term agreements with their customers to increase their market share and to meet the growing product demand. For instance, in March 2017, the company signed an agreement with the Defence Research and Development Organization (DRDO), India, to produce steel for weapons and combat vehicles.

Grade Insights

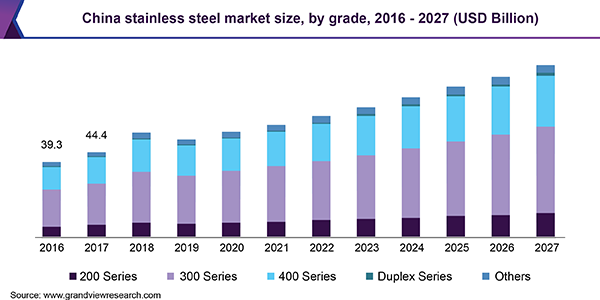

200 series accounted for a volume share of 17.5% in 2019 owing to its increasing demand from consumer goods. 200 series is considered to be cost-effective as the nickel which is generally used in manufacturing 300 series is partly replaced by nitrogen and manganese. The yield strength of 200 series is about 40% higher than that of 300 series, which is likely to provide a positive scope for product demand over the coming years.

300 series consists of about 6% to 20% nickel, and 18% to 30% chromium. The product is considered to feature high corrosion resistance and high-temperature resistance and is widely used in heavy industry and automotive applications. 200 series and 300 series are similar in terms of physical and mechanical properties but vary in yield strength and price factor.

400 series is anticipated to exhibit a CAGR of 5.7% in terms of revenue from 2020 to 2027 owing to its increasing use in compressor shrouds, valves parts and valves, screws, pump rods, food industry machine parts, machine parts, bolts, pistons, and cutlery. It has high carbon content giving it a martensitic crystalline structure and is used for applications involving high strength, heat resistance, and mild corrosion

Duplex series is projected to witness a CAGR of 6.2% in terms of volume over the forecast period owing to increasing demand from swimming pool structures, brewing tanks, and hot water tanks. The increasing demand from these applications is anticipated to propel the demand for stainless steel over the coming years.

Product Insights

Flat products accounted for the largest volume share in the stainless steel market in 2019 owing to the increasing use of cold-rolled products. Superior properties such as straightness, concentricity, and tolerance make them suitable in end-use industries such as energy, home appliances, and construction. The growth in these end-use industries is anticipated to drive the market for stainless steel over the coming years.

The long product segment is projected to witness a CAGR of 6.7% in terms of revenue from 2020 to 2027 owing to the increasing infrastructure spending in various Asia Pacific regions. The increasing use of stainless steel long products in heavy industries is anticipated to augment market growth over the coming years.

Application Insights

The automotive and transportation segment accounted for a market revenue share of 15.9% in 2019 owing to the increasing use of stainless steel in various auto components such as basic vehicle frames for doors, mufflers, hoods, and fuel tanks. Iron and steel make up about 70% of an automobile’s weight. According to the World Steel Association stats published in 2019, the global automotive industry accounts for nearly 12% of the global steel consumption. In addition, the drive towards increasing fuel efficiency by reducing vehicle weight is expected to further enhance the penetration of the product in the global automotive sector over the coming years.

Building and construction is one of the largest end-use industries of stainless steel products. Various infrastructure and construction sites require a massive amount of stainless steel to enhance aesthetic appeal and corrosion resistance of the structure. Rapid urbanization along with an increasing global population is likely to drive the demand for buildings and infrastructure. As per World Population Prospects 2017, United Nations, the global population is projected to reach 8.6 billion in 2030 and 1.2 billion more by 2050. This, in turn, is projected to fuel the demand for stainless steel over the coming years.

The heavy industry includes chemical industry, heating cooling and ventilation, oil and gas, pulp and paper, food processing, water treatment, and energy industry. Growing power consumption has led to the depletion of fossil fuels, thus propelling the need for renewable sources of energy including geothermal, wind, solar, and hydropower. The increasing demand for renewable energy sources is anticipated to drive the demand for stainless steel as it is largely used to manufacture equipment used in these sectors.

In the heavy industry, stainless steel is widely used in air handling units, gas heaters, heat exchangers, and several other cooling, ventilation, and heating components. The rising demand in this sector is on account of its ability to combine excellent corrosion resistance with non-contamination and other properties. It is an excellent material for commercial, industrial, and residential HVAC applications.

Regional Insights

Asia Pacific is anticipated to witness a CAGR of 5.4% in terms of volume owing to increasing manufacturing activities and foreign investments in the region. According to the United Nations Conference on Trade and Development, the inward Foreign Direct Investment (FDI) rate for Asia accounted for 9.1% in 2017, the highest of all regions. An increase in FDI helps to develop different industries in the country and generate more employment, which in turn is anticipated to propel the regional demand for stainless steel over the coming years.

According to the International Monetary Fund (IMF), the gross domestic product (GDP) of Asia Pacific was USD 30.2 trillion in 2018 and is expected to grow at a significant rate and reach USD 41.9 trillion by 2023. Asia Pacific continues to be the most dynamic component of the global economy. China, India, and Southeast Asia are among the fastest-growing areas, in terms of GDP, in the Asia Pacific. GDP growth is linked to the output from manufacturing and other sectors. Demand from different manufacturing sectors such as automobiles, heavy industry, and consumer goods is also projected to increase over the coming years, thus propelling market growth in the region.

North America is second among the fastest-growing regions in the market for stainless steel owing to the rising construction and consumer goods industries. The aging of infrastructure remains a key factor in the region’s construction industry. As per the 2017’s report of the American Society of Civil Engineers, the U.S. received a D+ grade for its infrastructure and needs to spend around USD 4.5 trillion by 2025 on the country’s infrastructure.

Europe is characterized by the presence of a large number of automakers and auto component manufacturers in Germany and a massive aerospace manufacturing sector in France. As per the European Automobile Manufacturers Association, car registrations in Europe reached nearly 15 million in 2018. The growing demand for the auto sector is expected to have a positive impact on the market in this region.

Stainless Steel Market Share Insights

Some of the key market players include Acerinox S.A., Aperam Stainless, ArcelorMittal, Baosteel Group, Jindal Stainless, Nippon Steel Corporation, Outokumpu, POSCO, ThyssenKrupp Stainless GmbH, and Yieh United Steel Corp. These companies are investing in capacity expansion across various countries. For instance, in March 2018, Acerinox S.A. invested a huge amount in annealing and pickling lines. As per the company officials, this is the most advanced technological system in the global market for stainless steel and is likely to provide new opportunities to the company, as the line can produce a wide range of products.

Want to request a free sample report? Welcome to contact Grand View Research directly.