The 2015 World Machine Tool Survey

May 25, 2015

High productivity is at the heart of a healthy manufacturing economy. Low interest rates make it cheaper to get increased productivity through investment in capital equipment, like machine tools. In 2014, the largest economies invested at a higher rate, increasing their competitive advantage.

In a competitive global manufacturing marketplace, increasing productivity is the name of the game. One way to improve productivity is via a more skilled workforce. Another way is through more efficient equipment, like machine tools. It’s very easy to look at these two means of achieving higher productivity as strictly competitive. For example, this is the view when labor bemoans the introduction of robots or other more efficient capital equipment. But in reality, higher-skilled labor and more efficient machine tools are complementary: Higher-skilled labor is necessary to make the most of more efficient machine tools and vice versa. Therefore, it’s the appropriate combination of the two that leads to higher standards of living.

Exactly how these two factors influencing production are combined is governed by their relative costs. In recent years, the typical skill set of manufacturing laborers around the world has been on the rise. This is evident in the improved quality of machined parts. But a higher-skilled workforce demands higher wages and other benefits. At the same time, interest rates around the globe are hitting all-time lows, which has significantly lowered the cost of capital equipment. This dynamic of rising wage rates and declining interest rates means that it is now relatively cheaper to increase productivity through capital equipment investment. Because machine tools have a hand in virtually everything that is manufactured, the level at which countries invest in machine tools is a sign indicating which are spending with an eye to the future of a more highly skilled workforce. Current machine tool purchasing trends show that the strongest manufacturing countries are making greater investments in the latest machine tool technology.

The 2015 World Machine Tool Output and Consumption Survey reports on the level of investment in machine tool technology by most major manufacturing countries in 2014. Data for this report comes from research conducted by Gardner Business Media, the publisher of this magazine. The 2014 data on production, exports and imports were collected from 27 countries that consume and produce virtually all of the world’s machine tools. Consumption is calculated by adding imports to and subtracting exports from production figures. The data typically are reported in local currencies then converted to U.S. dollars. After this conversion, all of the data in this year’s survey also were inflation-adjusted using the Bureau of Labor Statistics’ Producer Price Index for capital equipment to provide a better historical comparison.

In calculating these world totals for a particular year, we use the data from that year’s top 25 consuming or producing countries. So, for example, the total world consumption in 2002 is from a different set of countries than the total world consumption in 2010. Although the total number of reporting countries changes from year to year, this approach provides a reasonable approximation, because the top 25 consuming or producing countries account for roughly 95 percent of all consumption and production in any given year.

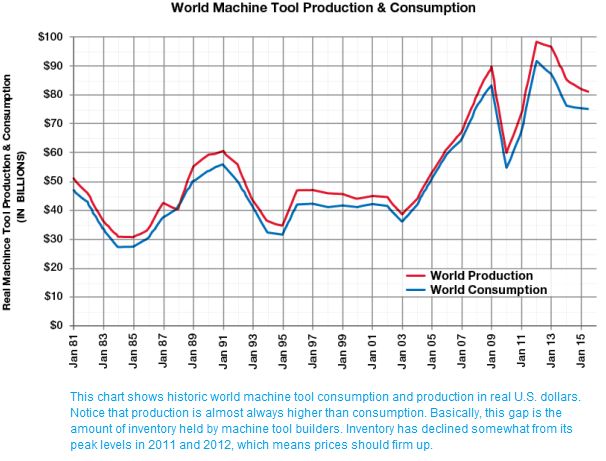

Global machine tool consumption in 2014 was $75.3 billion, an increase of just 0.3 percent from the year before. But among the 10 largest machine tool consuming countries, which generally corresponds with the 10 largest global economies, machine tool consumption increased 1.7 percent in the year. In the other 15 countries whose data were used to estimate the global total, machine tool consumption contracted 7.9 percent. So the countries with a stronger manufacturing base made a much larger relative investment to enhance the productivity gap between them and everyone else.

World machine tool production fell for the third year in a row to $81.2 billion, a decrease of 3.1 percent. However, this rate of contraction in production moderated in 2014 as machine tool builders decreased inventory levels, bringing supply into a better balance with demand. This is an indication that machine tool prices around the world should be firming up.

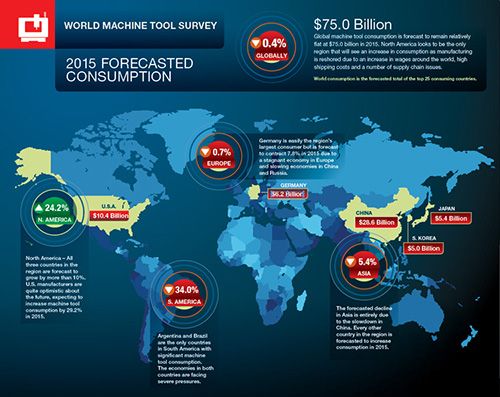

This year, I am forecasting that total world machine tool consumption will fall 0.4 percent to $75 billion. However, while the 10 largest machine tool consumers will see a decline of 1.1 percent, the remaining 15 countries in the top 25 will see consumption increase 3.7 percent.

World Consumption Highlights

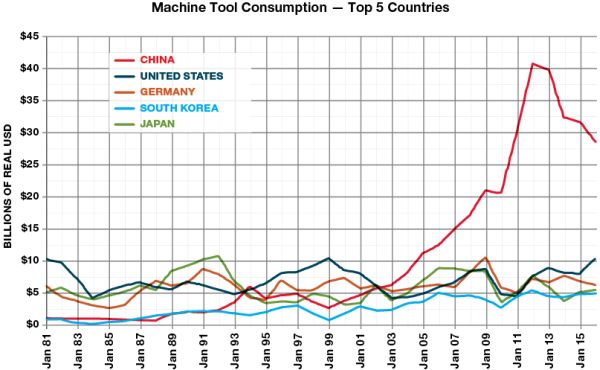

China remained the world’s largest consumer of machine tools last year by a wide margin, although its consumption dropped to $31.8 billion in 2014 from $40.8 billion in 2011—a 22 percent decline over three years. Because China’s money supply is growing at nearly its slowest rate in decades and its industrial production has grown at a continually slower rate since January 2012, I think China’s machine tool consumption will decline again in 2015. I am forecasting $28.6 billion in machine tool consumption for the country.

At $8.1 billion, machine tool consumption was essentially unchanged in the United States, which is the world’s second-largest machine tool consumer. I expect U.S. consumption to increase to $10.4 billion in 2015. Here is my rationale for why that is likely to happen.

Germany remained the third-largest machine tool consumer in the world in 2014; however, its consumption dropped by 10.8 percent, the second-largest percent decline of any country among the top 10 consumers. Germany’s money supply, industrial production and capacity are all growing at decelerating rates, therefore I think its machine tool consumption is likely to fall by another 8 percent this year.

Japan and South Korea remained in the top five of consuming countries, but they traded places on the list, with Japan rising to No. 4 and South Korea falling to No. 5. Last year, Japan’s machine tool consumption increased 39.4 percent, the largest increase of any country. It should see an increase in consumption in 2015 as well, albeit a much smaller one. Consumption increased by 13.2 percent in South Korea in 2014, and, like Japan, it should see a smaller increase in 2015.

Two countries that have seen significant declines in machine tool consumption in recent years are India and Brazil. In 2011, both countries consumed close to $2.5 billion and were ranked No. 6 and No. 7 in the world, respectively. However, in 2014, India consumed just $1.4 billion of machine tools and Brazil just $1 billion. India seems to be turning around, however, as I think consumption will increase in 2015 for the second year in a row. Brazil looks to be a different story. I believe consumption will drop to $700 million this year, as both its industrial production and capacity utilization are contracting at rapidly accelerating rates.

World Production Highlights

In addition to topping the list of machine tool consumers, China also has been the world’s largest producer of machines tools since 2009, but its production fell in 2014 to $23.8 billion from its peak of $29.5 billion in 2011. Given the nature of China’s machine tool market and the cooling off of its economy, production is likely to decline further in 2015.

For the second year in a row, Germany was the second-largest producer of machine tools; however, production declined roughly 20 percent. The county is also the world’s largest exporter of machine tools.

In Japan, machine tool production dropped nearly 50 percent from 2011 to 2013, but production rebounded in 2014, increasing to $12.8 billion. This put Japan in third place in the world, just $100 million behind Germany.

South Korea moved up one spot to No. 4 on the list of top machine tool producers, while Italy fell one spot to No. 5. Both countries produced more than $5 billion in machine tools.

Since 2011, Brazil’s machine tool production has taken a dramatic hit, dropping nearly 70 percent to $300 million from $900 million.

In addition to the consumption and production data summarized here, the 2015 World Machine Tool Output and Consumption Survey contains export and import data for each of the 27 reporting countries. You can find the full report with the online version of this article, as well as a link to forecasts and leading indicators for the top 25 consuming countries.

Source: The Modern Machine Shop