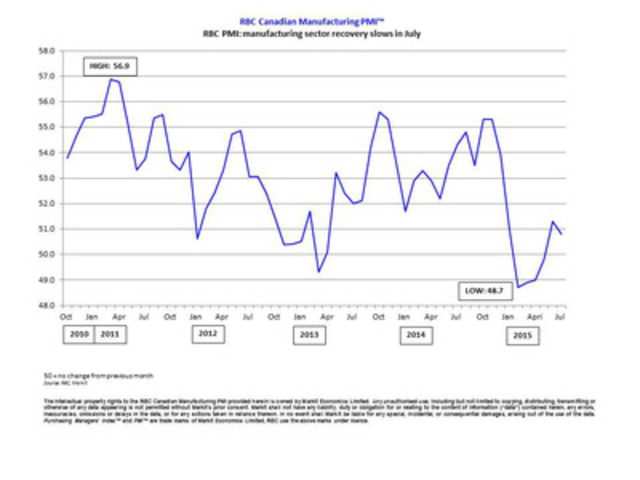

RBC Canadian manufacturing PMI remains positive in July

Aug 06, 2015

The latest RBC PMI survey highlighted sustained expansion of production and new business volumes in July, which underpinned an improvement in operating conditions for the second month running. . Increased export sales continued to support the manufacturing sector rebound, though the overall speed of recovery slowed from the six-month high recorded in June.

A monthly survey, conducted in association with Markit, a leading global financial information services company, and the Supply Chain Management Association (SCMA), the RBC PMI offers a comprehensive and early indicator of trends in the Canadian manufacturing sector.

At 50.8 in July, the seasonally adjusted RBC Canadian Manufacturing PMI dipped from June's six-month high of 51.3 but remained above the neutral 50.0 threshold. The latest reading was still stronger than the average for 2015 so far (49.9), and signaled a marginal upturn in manufacturing sector business conditions.

"The RBC PMI indicates a second consecutive month of improving business conditions in July though still at a very modest pace and slightly below that achieved in June," said Paul Ferley assistant chief economist, RBC. "As we enter the second half the year, a strengthening U.S. economy and weaker Canadian dollar should provide a greater boost to exports and business conditions for manufacturers."

The headline RBC PMI reflects changes in output, new orders, employment, inventories and supplier delivery times.

Key findings from the July survey included:

- RBC Canadian Manufacturing PMI remained above the crucial 50.0 no-change mark

- Output growth moderated from June's six-month high

- Renewed fall in employment levels

A modest increase in production volumes kept the headline index above the critical 50.0 no-change mark in July. Manufacturing output has now expanded for three months running, which firms mainly linked to a slight rebound in client spending.

July data pointed to a marginal increase in overall new business volumes; however, the rate of expansion was unmoved from the marginal pace recorded in June. A further modest upturn in new export work continued to boost manufacturers' order books. Anecdotal evidence mainly cited stronger demand from U.S. clients, helped in part by the weaker exchange rate. Manufacturers of consumer goods, especially those in the automotive sector, generally pointed to improving inflows of new work. That said, a number of manufacturers in the investment goods sector suggested that lower energy sector capital spending remained a drag on growth.

Despite rising levels of production and new work in July, the latest survey pointed to a renewed fall in staffing numbers across the manufacturing sector as a whole. Survey respondents that lowered their payroll numbers mostly pointed to the non-replacement of voluntary leavers in response to excess capacity. Backlogs of work meanwhile decreased for the eighth consecutive month in July, which is the longest continuous period since the survey began in October 2010.

Manufacturers in Canada remained cautious in terms of their inventory holdings in July, as highlighted by further slight falls in pre-production stocks and finished goods inventories. However, the latest reductions were slower than those recorded in June. Meanwhile, suppliers' lead-times continued to lengthen during July, which some manufacturers attributed to reduced stock holdings at vendors.

On the prices front, the latest survey highlighted a robust and accelerated increase in average cost burdens across the manufacturing sector. The rate of input price inflation was the fastest for three months, with a number of manufacturers noting higher prices for imported components and raw materials. Increased cost burdens in turn contributed to the most marked rate of factory gate price inflation since February.

The report is available at RBC (Royal Bank of Canada)

Source: Stockhouse.com